INSURE RIGHT NOW (SINGAPORE)

Business Registration No. 53248865B

+65 9131 2331

Call us today for a non-obligatory quote

Here we include the driver’s gender, age, residence, level of education, details of the driven automobile, make, model, year, and finally the desired coverage level. Once they have a general idea of the driver’s level of risk, then they can rate with a preferred, standard, or riskier non-standard rate.

Car insurance premium in Singapore is based on a point system that follows 2 categories of factors. Firstly, the Characteristics of the Driver insured, and secondly, the Characteristics of the Vehicle.

Category 1: Charateristics of the Driver Insured

a) Age of driver

-

The older you are the, the least your premium costs

-

Major factor that affects the price of your Car Insurance Premium

b) Gender and marital status

-

Cheaper for Females than Males

-

Cheaper for a Married person as compared to a single

c) Driving experience

-

The more Experienced you are, the less your premium costs

-

Calculated from the time you got your driving license

d) Nature of job (Indoor/Outdoor)

-

Cost more if job nature is Outdoor, and less if Indoor

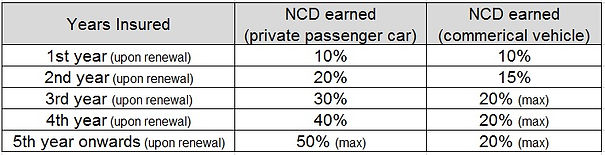

e) No Claims Discount (NCD)

-

NCD is discount (in % off the premium) extended to the car owner for maintaining a claims-free record whilst insured*. NCD is transferable among all motor insurers in Singapore. It is also transferable within parent / child / spouse.

f) Certification of Merit discount

-

Eligible for drivers that do not have any demerit points awarded for the past 3 yrs. An additional 5% off the premium (*only for drivers with NCD of 30% or more).

-

Check eligiblity for merit discount here.

Category 2: Charateristics of Vehicle

g) Body Type

-

Types of cars – Sedan, MPV, SUV, Sports Car, Station Wagon, etc.

-

Costs more to insure unusual types of vehicle.

h) Engine capacity (cc) and Engine type

-

The higher the engine capacity, the more your premium costs

-

Types of Engines - Normal or Turbo engine

-

Costs more to insure a car with turbo engine

i) Year of Manufacture

-

Year in which your car was made/registered

-

The older the car, the less you pay.

-

Some insurers refuse to offer comprehensive coverage for cars beyond 7 years old

j) Vehicle scheme (Normal/Off peak)

-

Some insurers offer a 15% discount for Off-peak cars

Different insurers are boasting various portfolios. Some companies are targeting riskier drivers, while others give plenty of bonuses for clean record drivers.

Shopping for affordable car insurance requires getting quotes from multiple insurers with different options and liability packages.

You simply fill out the form at Insure Right Now and we will provide you with multiple competitive quotes from various insurers that provide adequate protection for a reasonable price and best value for money.

How Insurers determine your car insurance premium

Vehicle owners are often in a dilemma not knowing what happens behind the scenes when their auto insurance quotes are calculated. Sometimes they are paying less, other times their premiums increased again. There are many different reasons why the policy rates fluctuate. Moreover, lots of specific details are playing a role when calculating the monthly rate of a driver.

Defining factors of a policy premium

Insurance companies are working on the basis of estimations and statistics. They try to estimate the risks of each driver when taking into considering all of the details that he or she can provide. Every piece of information that a vehicle owner provides is one small piece of a puzzle that has a large statistical impact on the end. They all count toward the estimation of the driver’s likelihood to file a claim.